Introduction – Selva Magal Savings Scheme

The Selva Magal Savings Scheme, also known as Selva Magal Semippu Thittam, offers a government-supported savings plan specifically designed for girl children in Tamil Nadu. Initiated under the national Sukanya Samriddhi Yojana (SSY) and rolled out across Tamil Nadu post offices and select banks, this scheme encourages early saving for a girl’s education and marriage. Since its launch in 2015 as part of the Beti Bachao, Beti Padhao initiative, it has gained wide acceptance across districts. Most importantly, it grants financial security, tax benefits, and high interest rates to families, especially from rural or low-income segments.

As of January 2025, Tamil Nadu achieved remarkable reach: more than 7.86 lakh accounts across southern districts held ₹5,219 crore in deposits, placing the state second nationwide in scheme participation. Notably, more than 34 lakh accounts opened in TN during 2023–24 alone. Thus, the scheme has become one of Tamil Nadu’s most successful female-focused financial initiatives.

Selva Magal Saving Scheme Objectives & Impact

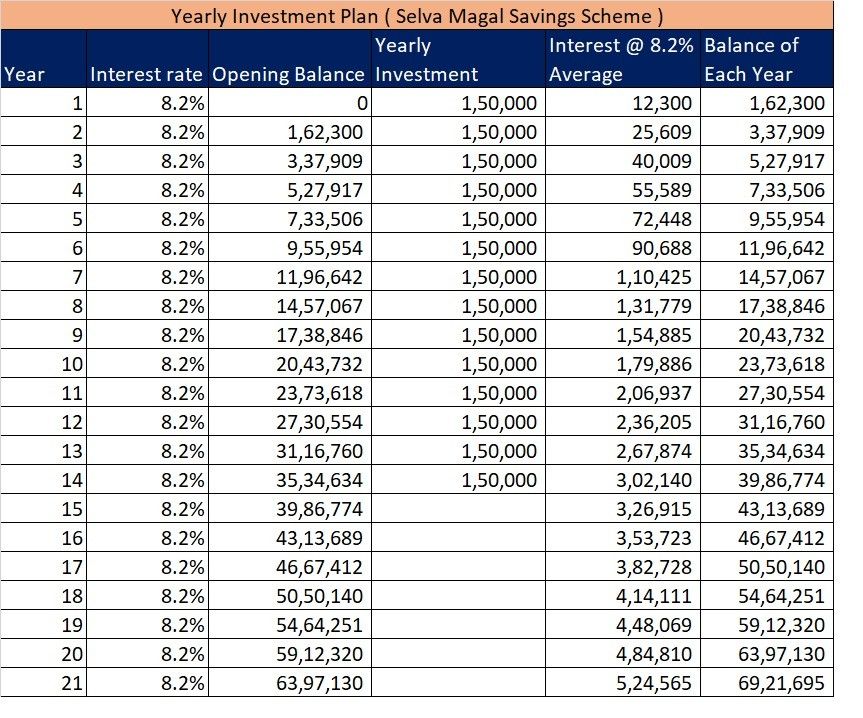

Primarily, the scheme encourages parents or guardians to save regularly for their girl child’s future needs, whether for higher education or marriage. Therefore, families gain a disciplined savings habit. Moreover, with interest rates around 8.2 to 9.1%, it outperforms many traditional deposit scheme. Besides financial returns, the scheme qualifies for tax deductions under Section 80C a major incentive for families up to the ceiling.

Consequently, participants build a long-term safety net that matures either at the child’s age of 21 or upon marriage after age 18. This maturity flexibility means funds can support higher studies or nuptials with minimal hassle. The plan also strengthens financial literacy, boosts women’s empowerment, and promotes economic participation by enabling ownership and independence

In addition, due to widespread enrollment, Tamil Nadu is now a renowned hub for SSY implementation, showcasing exceptional scalability in welfare outreach. As a result, the scheme enhances not only personal security but also contributes to gender equity and poverty reduction across the state.

Key Features of the Selva Magal Semippu Thittam

- Eligibility & Account Opening

- Available for girl children from newborn up to age 10. Only a maximum of two girl children per family can enroll, except in cases like twins.

- Parents, grandparents, or legal guardians may open an account at India Post or authorized banks.

- Deposit Guidelines

- Minimum deposit: ₹250 in a financial year. Maximum: ₹1.5 lakh. Deposits may be made monthly, quarterly, or annually, offering flexibility to suit varied family incomes.

- Missing a deposit still keeps the account active, though a nominal penalty may apply.

- Interest & Tax Benefits

- Interest rate usually hovers around 8.2–9.1% per annum, compounded annually.

- Contributions qualify for tax deduction under Section 80C (up to ₹1.5 lakh per year), and maturity amount is fully tax-exempt (EEE model).

- Withdrawal & Maturity Conditions

- Upon the girl reaching 18 years of age or completing Class 10, families may withdraw up to 50% of deposited funds for higher education.

- Full maturity occurs after 21 years from account opening, or on marriage after age 18 (withdrawal allowed one month prior, up to three months after marriage).

- Additional Benefits

- Loan facility allowed against savings at low interest—beneficial during emergencies.

- Account remains fully secure, backed by the Post Office and exempt from market volatility

Enrollment & Contribution Flexibility

Parents or guardians may begin contributions as early as a few months after childbirth. They can choose deposit schedules and amounts based on financial capacity. Moreover, even small contributions (₹250/year) keep the account alive, this approach helps economically vulnerable families participate.

Importantly, if the depositor misses a year, they can revive the account by paying a ₹50 fine with no penalties for long gaps otherwise. Meanwhile, interest continues to accrue uninterrupted. This structure encourages long-term participation without penalizing minor delays

State-Wide Reach & Enrollment Statistics in Tamil Nadu

Across southern Tamil Nadu’s postal circle, locals opened 38.38 lakh Selva Magal Savings Scheme (SSY accounts) by April 2023, ranking the state second nationwide in participation. As of March 2025, Tamil Nadu post offices oversaw deposit worth ₹1,798 crore within Chennai alone, covering over 10.44 lakh girl children. Moreover, Tamil Nadu achieved over 7.86 lakh accounts holding ₹5,219 crore as of January 2025.

These figures highlight both the scheme’s popularity and the state’s effective grassroots outreach via special camps in post offices during International Women’s Day, which spurred enrollment drives across districts.

Socioeconomic Impact of Selva Magal Savings Scheme

Selva Magal Semippu Thittam transcends savings, it builds financial awareness, women’s independence, and future planning capacity. In rural and marginalized communities, it enables parents especially women-led households to secure resources for education or emergencies. Families often use the accrued funds to support small businesses or invest in health and education.

Therefore, the scheme not only enhances financial security but also fosters gender equity, by ensuring daughters receive dedicated financial planning. As a result, many adolescent girls access higher education or delay early marriage. Ultimately, the scheme increases human development indicators and contributes to wider societal progress.

Challenges & Recommendations for Improvement

While the scheme boasts high participation, gaps remain. Many eligible families, especially in remote areas, still remain unaware. Cultural norms in conservative communities sometimes hinder women’s financial autonomy. Moreover, operational challenges such as account handling delays or limited banking access can affect continuity.

To strengthen impact, the government could:

- Launch robust awareness drives in local languages, collaborating with NGOs, SHGs, and schools.

- Simplify account opening via mobile teams in rural areas or online prepaid processes.

- Conduct financial literacy workshops to educate parents about savings discipline and tax benefits.

- Offer deposit match incentives or group bonuses for SHGs participating in the scheme.

By doing so, Tamil Nadu can further boost participation and deepen the empowerment outcomes that the scheme already generates.

Step‑by‑Step Guide to Participate

| Step | Action |

|---|---|

| 1 | Visit any India Post office or authorized saving bank branch. |

| 2 | Provide birth certificate of girl child and guardian’s ID. |

| 3 | Open SSY account under Selva Magal Thittam; deposit ₹250–₹1.5 lakh. |

| 4 | Choose deposit frequency: monthly/quarterly/annually. |

| 5 | Continue deposits up to 15 years; interest accrues even after. |

| 6 | At age 18 or Class 10, withdraw up to 50% for education. |

| 7 | Full maturity payouts occur at 21 or upon marriage after 18. |

Importantly, families should retain passbooks and KYC documents for updates and claim

Why It Matters – Selva magal Semippu Thittam

- Financial Security: It builds a dedicated fund for girl children’s future needs.

- Tax Savings: Contributions qualify under 80C; maturity is tax‑free.

- High Interest Returns: Between 8.2–9.1% makes it one of India’s most lucrative small savings instruments.

- Inclusive Reach: Even lowest-income households can open accounts with ₹250/year.

- Empowerment Track: Encourages gender-sensitive financial planning and education access for daughters.

Final Thoughts on Selva magal Semippu Thittam

The Selva Magal Savings Scheme (Selva Magal Semippu Thittam) stands as a pioneering financial initiative spearheaded by the Indian government and robustly implemented in Tamil Nadu. With millions of female children enrolled across the state and billions in cumulative investments, the scheme demonstrates how inclusive, long-term savings plans can transform lives. As a result, girls gain financial guarantees for education and marriage. Parents cultivate discipline and long-term thinking. Society benefits from increased financial inclusion and reduced dependency.

For official scheme details, account procedures, interest updates, and policy guidelines, visit the official India Post Small Savings portal or the Government of Tamil Nadu’s Small Savings Department here: Post Office Small Savings and Selvamagal Semippu Thittam.